FOMO. Fear of missing out.

It’s the acronym for a behavioral phenomenon where people worry they’re missing out on something important they believe may help improve their lives — information, the novel features offered by the latest smartphone or the desire to be part of an exciting shared experience like a pop star’s three-hour concert.

We’ve also heard much about FOMO in the investment world over the past few years. Many will recall the so-called meme stocks or cryptocurrencies, but we can likely find FOMO impacting investors beyond these cases.

Consider the recent interest in companies with seemingly any recognizable tie to artificial intelligence (AI). Surely, some investors have heard from friends and family or read about the perceived promise of AI and thought, “I better take advantage of that.” Loading up on companies they believe capture this opportunity might be their next step.

But problems can arise when making investment decisions based on emotions instead of sound investment principles. Common pitfalls in this type of decision-making include:

- Not being mindful of valuations (i.e., buying into high-flying stocks often means paying a high price versus fundamentals).

- Not understanding the risks (e.g., cryptocurrencies’ high volatility, an individual company’s unique risks—risk that is mitigated through a broadly diversified portfolio)

- Not considering how the desired investments fit into a long-term financial plan.

The outcome of chasing a trendy investment can easily stray from the benefits we had in mind.

Putting FOMO to Good Use

But investors might benefit from FOMO in at least one instance.

In our view, broad U.S. stock market returns this year exemplify why investors should fear missing out on the opportunity that comes from sticking with a broadly diversified portfolio over the long term.

While a disappointing 2022 left many predicting more tough times for the market in 2023, U.S. stocks have delivered strongly positive returns through the first seven months of this year, and major market indexes are now nearing all-time highs.

Figure 1 shows index level changes over the past three years for the S&P 500® and Russell 3000® indexes. It highlights how the year-to-date returns (around 20%) close in on the prior index peaks in early 2022. The narrower but oft-cited Dow Jones Industrial Average has also done well this year, returning about 8.5%, now about 0.2% from its all-time high.

Figure 1: Nearing All-Time Highs, the U.S. Stock Market Has Delivered Strong Returns in 2023

Data from 7/31/2020 – 7/31/2023. Source: Morningstar, Avantis Investors.

Past performance is no guarantee of future results.

These results may seem surprising if we focus only on the headline risks we hear about in the financial media — recession fears, potential impacts of higher interest rates on consumer spending or company profitability. While these are no doubt real risks, we should remember that stock prices incorporate current information on company opportunities and risks so that there’s an expected positive return for investing each day.

We know we won’t always see positive returns, but we shouldn’t be surprised when the market delivers on this expectation. More importantly, we think investors should be mindful of the risk of not being invested when these positive returns appear. Historically, the market has grown despite many short-term periods of decline, so the risk of missing out is high if you’re not invested each day.

Putting it in Historical Perspective

In practice, we know there are times when it can feel challenging to maintain sight of these important investing principles. Such times may include the periods of heightened volatility we saw in 2022 or periods like this year when the market has run up. This can prompt fear that the market may have peaked, and a decline or correction may soon follow.

We’ve just laid out theory that helps explain why we don’t believe investors are well served acting on these fears by abandoning or reducing their allocation to stocks. But you don’t have to take our word for it.

The long history of the market offers perspective on why we don’t believe we should now expect poor returns in the future and, even if we do see declines going forward, why investors are likely better off avoiding drastic changes to their allocation. We address this with two experiments.

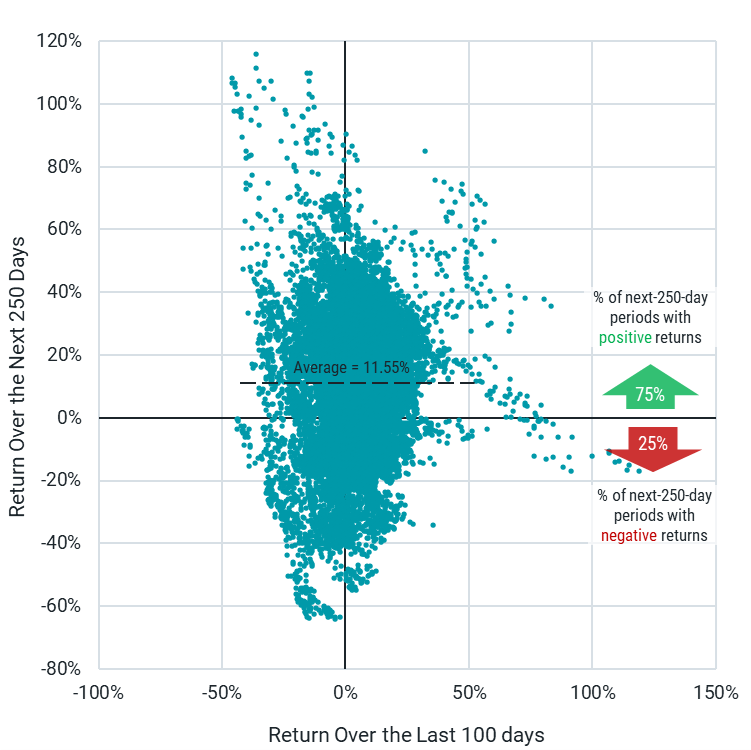

First, we examine whether recent market returns can help inform how the market will perform in the period that follows. Since much of the strong returns from the market in 2023 have come over the last five months (up about 15% since early March), we look at the relationship between the past 100 trading days (roughly five months) versus the 250 trading days that follow (roughly one year). We ran this experiment across all periods going back to July 1926 and plot the results in Figure 2.

Figure 2: Recent Market Returns Offer Little Information About Short-Term Returns Going Forward

Data from 7/1/1926 – 6/30/2023. The CRSP U.S. Total Market Index represents the market. Source: Avantis Investors. Past performance is no guarantee of future results.

The data forms a cloud with no discernable pattern, which tells us that recent returns don’t seem to inform the returns that follow. What stands out is that about 75% of the next one-year observations were positive. Regardless of whether the prior period was positive or negative and no matter the magnitude of the return, the following-period returns have more often than not been positive and, on average, about 11.5%.

Perhaps more interesting, when we look at the one-year period returns following five-month periods of 15% or more, as shown in Figure 3, the results look similar to the one-year average from the market over all periods going back to 1926. The split between positive and negative periods is also strikingly similar whether conditioning for recent market rallies or not.

Figure 3: One-Year Returns Following Market Rallies Look a Lot Like the Long-Term Average

Figure 3: Data from 7/1/1926 – 6/30/2023. The CRSP U.S. Total Market Index represents the market. Source: Avantis Investors. Past performance is no guarantee of future results.

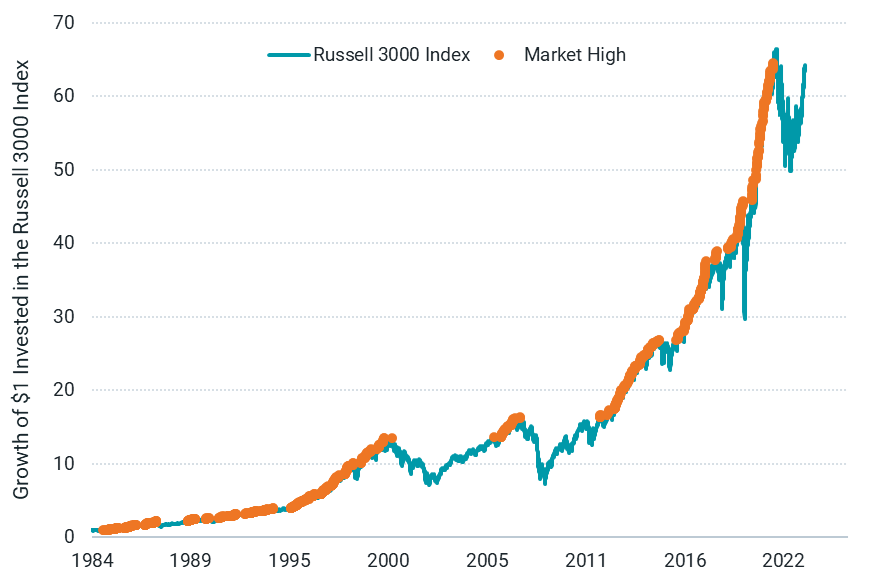

In our second experiment, we address the common perception that reaching market highs may suggest the market is due for a pullback. In Figure 4, we highlight that the market is no stranger to highs by plotting the growth of a dollar invested in the Russell 3000 Index since its inception at the start of 1984, with each new market high represented in orange.

Figure 4: The Market Has Reached Many New Highs Over Time

Figure 4: Data from 1/1/1984 – 7/31/2023. The market is the Russell 3000 Index. Source: Bloomberg, Avantis Investors. Past performance is no guarantee of future results.

Over these nearly 40 years, there have been more than 1,000 new highs when looking at the daily closing level of the index. On average, the one-year return following these peaks has been about 13%, with more than 80% of these periods positive and just under 20% negative. So, contrary to what some may expect, new market highs are in no way a harbinger of market declines.

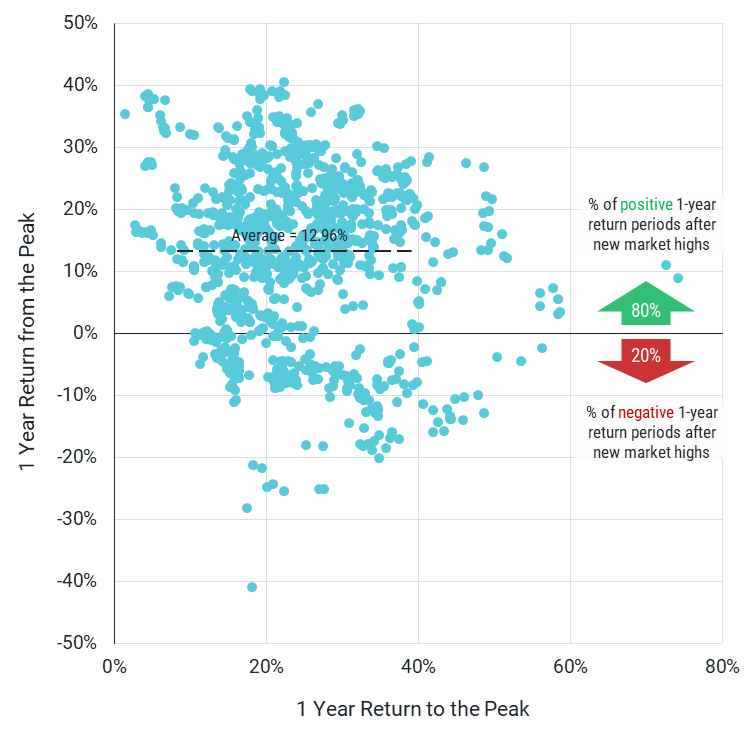

In Figure 5, we take a deeper look at these one-year return periods following market peaks, plotting each against the preceding one-year return. Again, we find a cloud-like pattern, which suggests that the magnitude of the one-year return before a market high also tells us little about what returns will follow. Still, we find good news: The market delivered positive returns in the year after a new high in about four out of five cases.

Figure 5: The Market Is Often Positive After New Highs Regardless of Prior Returns

Data from 1/1/1984 – 7/31/2023. The market is the Russell 3000 Index. Source: Bloomberg, Avantis Investors. Past performance is no guarantee of future results.

Key Takeaways for Investors

- The market may rise or fall going forward, but there’s no reliable way to predict precisely when market peaks or valleys will start and end.

- Historically, the positive returns we expect from stocks have been realized more often than not following periods of recent positive returns or new market highs.

Because markets have positive expected returns every day, it means the market will have many peaks over time, so we believe investors shouldn’t worry when it reaches new highs.

To put a bow on this, we think investors shouldn’t lose sight of the fact that the broad stock market has historically offered a powerful driver for long-term growth in investor allocations and without the company- or other investment-specific risks that may come with chasing the trendy investments of the day.

In our view, missing out on that is truly something worth fearing.

Investment advisory services offered through Navigate Wealth Management LLC, a registered Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Navigate Wealth Management also markets investment advisory services under the name Abeona Wealth.